PCI DSS Security Standards Council

PCI DSS is a widely used set of policies and measures aimed at optimizing the security of card transactions and protecting cardholders from unauthorized use. This set of rules does not apply to legal norms, but their compliance is often included in contractual obligations.

The history of the creation of PCI DSS starts in 1999, and among the initiators of its development are the five largest credit card companies — Visa, Mastercard, Discover, JCB and American Express.

What is PCI DSS (Payment Card Industry Data Security Standard)?

The Payment Card Industry Data Security Standard (PCI DSS) is a comprehensive set of security standards designed to ensure the protection of sensitive payment card information. Established by the PCI Security Standards Council (PCI SSC), a global organization founded in 2006, PCI DSS provides guidelines and requirements to enhance the security of payment card transactions and safeguard cardholder data.

PCI DSS is crucial for businesses that handle credit card transactions, as it helps prevent data breaches and secure sensitive information. The standard applies to all organizations involved in payment card processing, including merchants, financial institutions, and service providers.

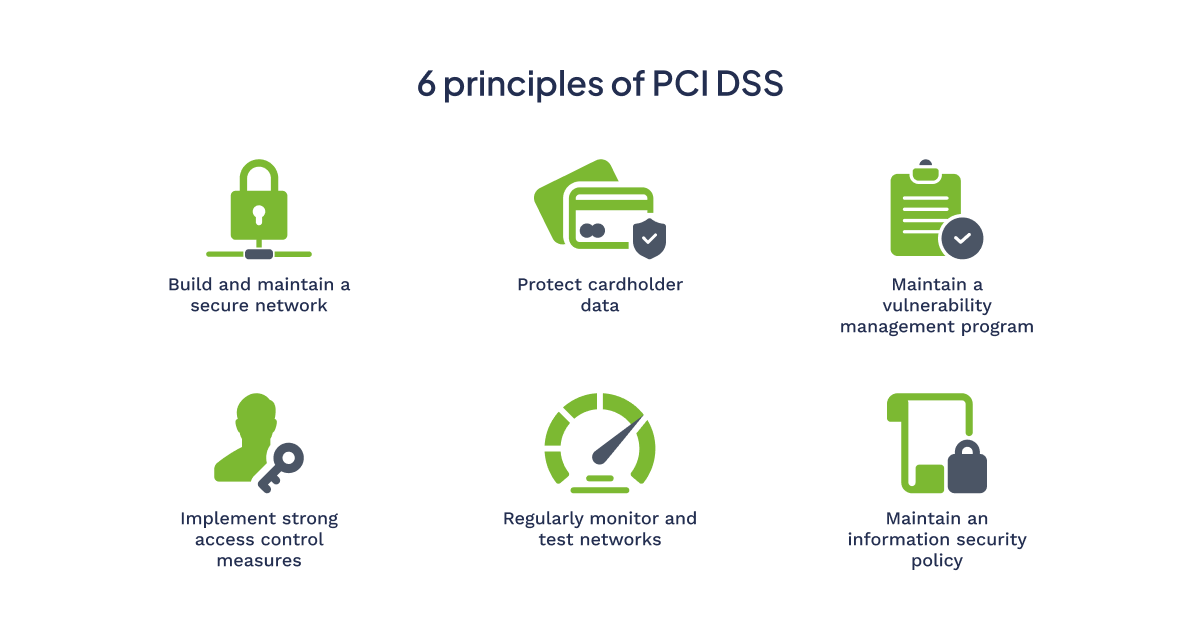

What are the 6 principles of PCI DSS?

PCI DSS is built upon six core principles that serve as the foundation for securing payment card data:

- Build and maintain a secure network. This principle focuses on establishing and maintaining a secure network infrastructure by implementing firewalls, encrypting data during transmission, and ensuring the use of secure protocols.

- Protect cardholder data. Businesses must implement strong measures to protect stored cardholder data. This includes encryption, access controls, and regular security assessments to identify and mitigate vulnerabilities.

- Maintain a vulnerability management program. Regularly update and patch systems, applications, and devices to protect against known vulnerabilities. Conduct regular vulnerability assessments and implement measures to address any weaknesses.

- Implement strong access control measures. Restrict access to cardholder data and ensure that only authorized personnel have access. This involves unique IDs, role-based access controls, and regular monitoring of access logs.

- Regularly monitor and test networks. Implement continuous monitoring and testing procedures to promptly identify and address security vulnerabilities. This includes regular security testing, monitoring access points, and analyzing system logs.

- Maintain an information security policy. Develop and maintain a comprehensive security policy addressing all PCI DSS compliance aspects. This policy should be communicated to all employees and contractors and regularly reviewed and updated.

Read also: Decoding PSD2 Directive: A Perspective on Regulatory Technical Standards (RTS)

What are the requirements of PCI DSS?

PCI DSS outlines a set of specific requirements that organizations must adhere to in order to achieve and maintain compliance. These requirements are organized into 12 key areas:

- Install and maintain a firewall configuration to protect cardholder data.

- Do not use vendor-supplied defaults for system passwords and other security parameters.

- Protect stored cardholder data.

- Encrypt transmission of cardholder data across open, public networks.

- Use and regularly update anti-virus software.

- Develop and maintain secure systems and applications.

- Restrict access to cardholder data by business need-to-know.

- Assign a unique ID to each person with computer access.

- Restrict physical access to cardholder data.

- Track and monitor all access to network resources and cardholder data.

- Regularly test security systems and processes.

- Maintain a policy that addresses information security.

Read also: Everything You Need to Know About eIDAS Regulation

PCI DSS compliance levels

PCI DSS compliance is not one-size-fits-all; rather, it is categorized into four levels based on the volume of annual transactions a business processes.

The compliance levels determine the specific requirements and validation procedures that an organization must follow:

Level 1: Merchants processing over 6 million transactions annually.

Level 2: Merchants processing 1 to 6 million transactions annually.

Level 3: Merchants processing 20,000 to 1 million e-commerce transactions annually.

Level 4: Merchants process fewer than 20,000 e-commerce transactions annually, and all other merchants process up to 1 million transactions annually.

Each level has its own set of validation requirements, with Level 1 requiring the most rigorous assessments and security measures.

Read also: Enterprise Cyber Security: Best Practices

Benefits and challenges of PCI DSS compliance

Benefits:

- Enhanced security. PCI DSS compliance ensures a higher level of security for payment card transactions, reducing the risk of data breaches and fraud.

- Customer trust. Compliance signals to customers that their sensitive information is handled with the utmost care, fostering trust and loyalty.

- Legal compliance. Meeting PCI DSS requirements helps organizations comply with various data protection laws and regulations.

- Brand protection. By safeguarding customer data, businesses protect their reputation and brand from the negative impact of security incidents.

Read also: Key Steps to Improve Cybersecurity in Healthcare

Challenges:

- Complexity. Achieving and maintaining PCI DSS compliance can be complex and resource-intensive, especially for smaller businesses with limited IT resources.

- Cost. Implementing the necessary security measures and undergoing regular assessments can incur significant costs, which may be a challenge for some organizations.

- Constant evolution. The threat landscape and security technologies evolve over time, requiring organizations to continuously adapt to new challenges and update their security measures accordingly.

Best practices

- Start early. Begin the compliance process early to allow sufficient time to implement and test security measures.

- Scope reduction. Limit the scope of cardholder data to reduce the complexity and cost of compliance.

- Regular training. Provide regular training for employees on security policies and procedures to ensure awareness and compliance.

- Regular audits. Conduct internal and external audits to identify and address vulnerabilities proactively.

- Engage security experts. Consider leveraging the expertise of security professionals to assess and enhance your security posture.

- Stay informed. Stay updated on the latest developments in security threats, technologies, and PCI DSS requirements to adapt your security measures accordingly.

Read also: Best Practices of Security & Protection of Mobile Applications

How to Develop a PCI-Compliant Product

PCI DSS is a crucial standard for securing payment card data, and organizations must prioritize compliance to protect both themselves and their customers. By understanding the principles, requirements, and best practices associated with PCI DSS, businesses can establish a robust security framework that meets compliance standards and enhances overall cybersecurity.

Software Development Hub company has competencies in finance software development taking into account PCI DSS standards and will help in creating a product that meets current cybersecurity challenges.

Get a free estimation of new product development!

Categories

About the authors

Share

Need a project estimate?

Drop us a line, and we provide you with a qualified consultation.