Startup Funding Rounds: Seed Series A, B, C

Raising capital from investors is usually a very daunting and time-consuming process that is very heavy and uninteresting or demoralizing. To maintain the desired strength in the showdown and to keep a high level of motivation, it is crucial to focus on the end result of attracting the right resource, i.e. your capital, which shall enable the aspiring business to bring your ideas to life

A major concern when supporting startups' financial needs, is that too much demand of the founder's work leads to burnout and severe stress due to the lack of financial inputs. Moreover, the duties to be performed are - firstly, maintain the company and secondly, raising investments.

As practice shows, it takes around 3-4 months in average to raise money, although less or more time is possible too. However, this varies depending on the situation and also on the investors' experience and their readiness to invest.

One more challenge comes from the growing number of people among whom the founder has to associate at various rounds of startup funding. New investors may be not only interested in making a profit, but also in gaining real influence at the company and that forms the risks for the founder as well because then the founder might lose their position.

Nevertheless, with myriad hassles on the ground, a prospective financial return in the occurrence of the success is much larger than the regular problematic scenarios. In order to get accustomed to the process of injecting funds, you should first go through the overviews of startup rounds.

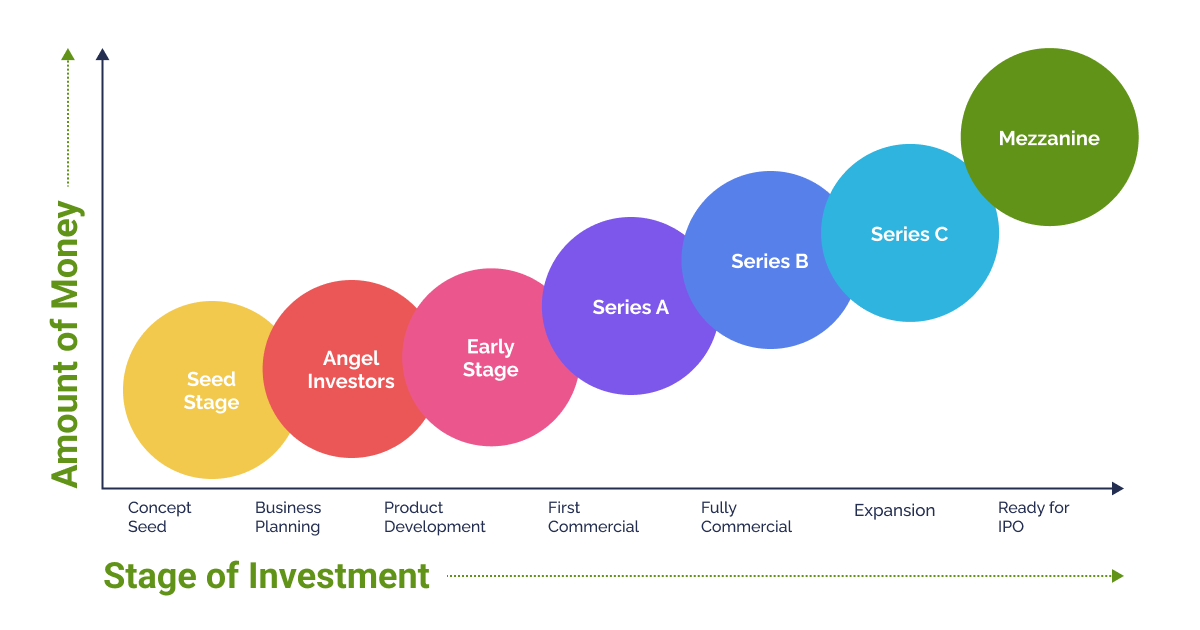

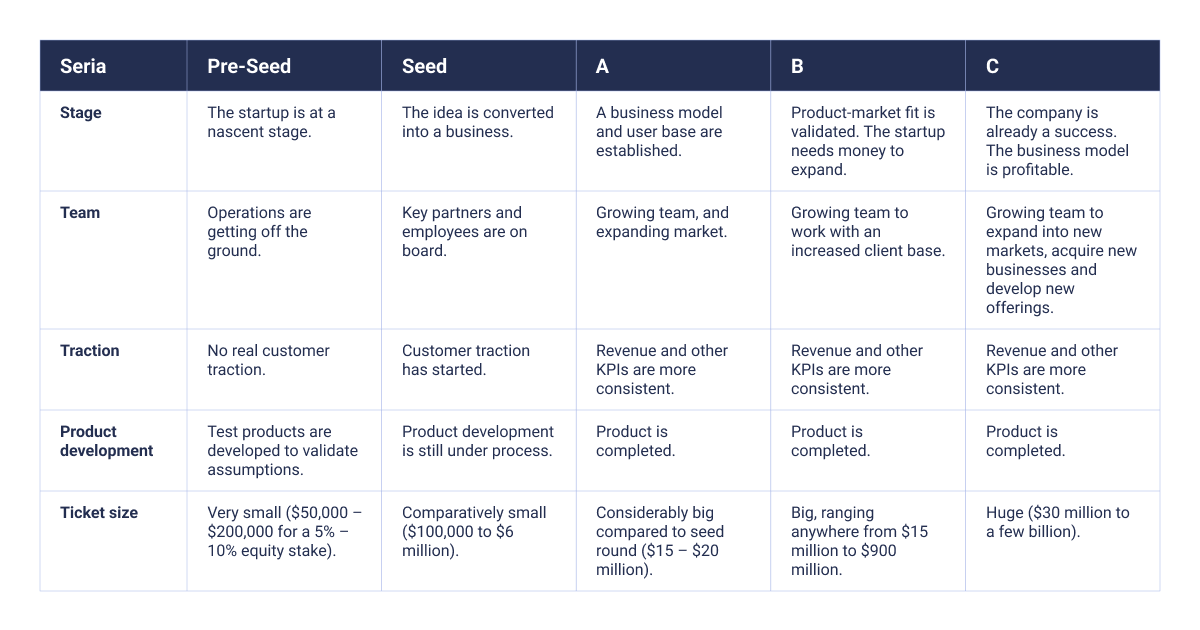

Pre-funding (Pre-Seed)

Pre-funding actually refers to the initial stage of investment in a project. Hence, very often the stage is not even included in the equity financing cycle.

The pre-stage implicates the existence of only a minimal number of people who are working on the prototype, or proof of concept. Capital is provided by the founders' close associates, the angel investor. It is not easy to measure the amount of financing that is accrued at this time.

Initial funding (Seed)

The obtaining of the first funds is the initial or seed phase. What is seed funding? It includes small financial means that bring "plant parts" of the project and make sure it is viable and profitable. Initial financing is used when a startup moves from the idea to the first steps in practice.

However, for some companies, this higher threshold becomes a full stop. The owners are forced to speak of their so-called failure if a startup doesn't cause a stir before the first runout of money. A certain percent of the company decides to suspend the collection of funds at the initial stage in case enough funds are accrued or the project can stay afloat on its own.

What amounts of money are usually involved in seed financing? As a rule, the amount is from $500,000 to $2,000,000, but the figure can go up or down sometimes. The worth of a firm that succeeded in getting funds at the first stage is from $3,000,000 to $6,000,000 on average.

Read also: How to Find Investments for Healthcare Startups

Series A funding

Once the startup founders get the initial investment (which is marked by more users, some income, number of views, and other KPI defined by the company itself), series A funding takes place. Therefore, this will happen if the project succeeds to the next stage.

During this period, the startup team informs the investors about their business model and uses the funds secured for expanding the profits. In the given example, the Series A funding should be $"2,000,000-$15,000,000 for it to be considered successful. You should be prepared to see the investors demand to increase their profits.

The resolution to be made in the first place is what actually attracts the first investor that acts as the warranty for other shareholders. Consequently, when this investor leaves, the startup is bound to failure. А series is the funding done by venture capitalists, angels, and crowdfunding. Nevertheless, facts indicate that not entirely the firms doing a seed stage qualify for Series A funding.

Series B funding

The product matching directs towards the stage in which a startup can rise to Series B round by introducing the market and extending the existing market. The main challenge that the founder is in front of now is how to make the company work after the scale-up. Furthermore, it is not just the clients that grow, but also the startup team grows to serve a bigger audience.

Series B funding, which is $7,000,000 to $10,000,000, when the company is worth between $30,000,000 and $60,000,000, is the amount of the funding. They are venture capitalists and can be the investors of the previous round, investing their money at this stage. The startup is getting another round evaluation and investors from the previous one are backing it again to validate their promises.

Series C funding

The company will need to raise money to support Series C when it feels it is ready to enter the new market, take over the new business, build and introduce the new products. The estimated value of the company is then increased.

The investments made by the investment bankers and the shareholders of the private sector are proof of the startup's reliability. Those investors, who previously mentioned only finance leaders for security and returns, are the first to come. In truth, series C is the last round, although some experts think series D and E are the next stages of funding as well. The fund is estimated to be about $26,000,000 or more, and the company would be valued between $100,000,000 and $120,000,000.

Read also: MVP vs Beta-version: What is the Difference?

Consulting and Software Development for Startups

The Software Development Hub has been involved in the consulting and the startup skill acquisition process, including IT startups which put forward cutting-edge technologies at the very beginning of the firm's birth cycle - pre-seed, seed, and series A stages. SDH is a strong tech partner that manufactures friendly-cost flexible solutions for IT startups. To create products that cater to their wishes, we work with IT startups and offer them the following:

- IT consulting

- Discovery phase

- UX and UI design

- Software engineering

- Agile project management

- HR and recruitment services

- Technology stack advisory and more.

Ask for a free consultation!

Categories

Share

Need a project estimate?

Drop us a line, and we provide you with a qualified consultation.